Forms, Links and Resources

Congratulations on your New Position & Welcome to Macalester!

Faculty, Staff and Students accessing 1600grand have the ability to enroll in direct deposit, update W4 elections, change tax filing status, view/print payroll & tax statements and request duplicate W-2 forms for current and previous years.

Below is a collection of our online eforms. Contact Payroll at [email protected] for questions

Payroll Forms and Self-Service Link

-

Direct Deposit Authorization Login to 1600grand required -

W-4 Federal & MN Forms Please complete all the mandatory fields (highlighted in red) and any optional fields (highlighted in green) that might apply. Once completed, select Finalize Document and the form will be sent to the Payroll department securely and automatically.

Please complete all the mandatory fields (highlighted in red) and any optional fields (highlighted in green) that might apply. You can only complete Section 1 or Section 2, NOT BOTH. Once completed, select Finalize Document and the completed form will be sent to the Payroll department securely and automatically.

-

Electronic W-2 and 1095-C Consent Form (secure e-Signature) Please complete all the mandatory fields (highlighted in red) OR

For Self-Service, login into 1600grand, go to Employee Dashboard, open Taxes, and select Electronic Regulatory Consent link, and select to receive W-2 and 1095-c electronically.

-

Request for Duplicate Copy of W-2 for Former Employees Please complete all the mandatory fields (highlighted in red) and any optional fields (highlighted in green) that might apply. Once completed, select Finalize Document and the completed form will be sent to the Payroll department securely and automatically. Once the completed form has been received; the request will be processed in 2 business days

-

Timesheet Correction Request Helpful Tips & Information

The Online Timesheet Correction Request is designed for employees to record any missed hours that were not paid on their last paycheck or past paychecks. Refer to your pay stubs on 1600grand for pay period dates if unsure.

Any missed hours not paid for an actively open pay period are considered the current pay period and should be directed to your supervisor to take the appropriate action to ensure those hours are entered. The online timesheet request is NOT required for this situation, please reach out to your supervisor.

Helpful Tips & Information:

- Missed hours for multiple pay periods? – Seperate timesheet correction requests are required for each missed shift

- Missed hours for a pay period that has not been paid yet, please reach out to your supervisor to take the appropriate action to ensure those hours are entered. This request is NOT required

- Missed hours recorded should NOT reflect the following:

- Negative hours

- More than 12 hours shifts

- Earn codes used should only be what is listed in the drop-down menu

- Missed hours recorded should reflect the following:

- Paired clock times (clock in/out)

- Fractions of hours must be rounded to the nearest 15 minutes and entered as a Fraction of the hour – for example 5:09 → 5:15

Access/Complete online Timesheet Correction Request

- Log onto 1600grand

- Under Student/Union Time Clock, click on Timesheet Correction Request

- Under Macalester Jobs – EE Name section

- Review job information, select the job you are requesting the correction for (If you have multiple jobs, you will see them listed separately by line item)

- If you do not see your job listed, please contact [email protected]

- Under Macalester Jobs – EE Name section

- Click Submit a Correction

- Edit online Timesheet Correction Request (All fields are required)

-

- Under Timesheet Correction Request section

- Select the date and time for the missed hours from the drop-down lists (Please note the hours should be rounded to quarters of hours – for example 5:09 → 5:15))

- Select the Earn code for the shift (the reason for the request) from the drop-down

- Enter a comment for your supervisor to review

- Check the box indicating you acknowledge all information is accurate

- Confirm all information is correct, click Send to Supervisor this will route your request to your supervisor for their approval. They will be notified within one business day.

- Under Timesheet Correction Request section

Once successfully completed and routed to your supervisor the Online Timesheet will transition to the supervisor queue for approval.

Once successfully approved and processed by Macalester Payroll, the employee receives an auto-generated email to their mailbox indicating Timesheet Correction(s) Processed

Employees can check the status of their submission at any time from the Portal under “My Submitted Corrections”.

Review/Approval Process

- Navigate to Employee’s timesheet correction form by clicking on the request form link provided in the email notification you received, Click Go to Portal

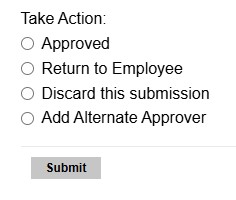

- Review request for accuracy, determine corrective action (use the option that is applicable under Take Action)

-

- Select Approve Hours to approve the Timesheet Correction Request

- Select Return for Correction – you will be prompted to enter a brief message that will be available to your employee upon return

- Select Discard to delete the timesheet from the system if no longer valid (Use this if timesheet is for current open pay period, negative hours, insufficient vacation and or sick time requested and long shifts)

- Select Add Alternate Approver to route the timesheet to the supervisor you designate as the alternate approver, and notify them by email.

- If no corrective action is needed, proceed through the approval process:

- Click Approved

- Click Submit to route your approval to Payroll for processing

- If request(s) is for the current pay period the following action is required by the supervisor:

- Enter hours in TCP

- Select Discard

- Click Submit

Troubleshooting Online Timesheet Correction request

Problems with routing the approved timesheet request for processing

Troubleshooting Tips:

- If you experience any issues with routing the approved online timesheet correction request to Payroll for processing please contact Payroll at [email protected],

- Once successfully approved the online timesheet request will remove from your queue and route to Payroll for processing.

Contact Payroll at [email protected] with questions

-

Faculty and Staff Payroll Deduction to Macalester If you have questions or concerns please reach out to [email protected]

Resources Links

-

IRS Withholding Estimator The IRS Withholding Estimator calculates what your tax obligation will be for the current year based on your expected earnings. From there you can select whether you want a refund or to have only your tax obligation withheld. The tool then tells you how to complete your W-4 for the year.