As a Pcard Approver, you are are required to review and approve Pcard expenses for your assigned cardholders. You will receive regular Wells Fargo email reminders indicating you have transactions that require coding. Cardholders are able to reconcile expenses as soon as they post to their account, and then submit expenses for approval. It is highly recommended for cardholders to do so on a regular basis, and the final deadline is typically 11:59pm on the 6th of the month for all previous month’s expenses. Approvers can approve Pcard expenses as soon as the cardholder submits them, and typically have through 11:59pm on the 10th of the month for all previous month’s expenses.

To review and approve cardholder Pcard expenses

Getting Started & Approval Guidelines

Getting Started & Approval Guidelines

The new WellsOne Expense Manager is a transaction based platform, which deviates from the previous statement based platform. This means that you will approve expenses by the transaction, not by the statement as a whole. There is no “Approve Statement” button to press in the new platform; instead, you officially approve expenses by clicking the Approve button on each expense.

Your role is to verify that each transaction has an appropriate FOAPAL, description, and uploaded receipt.

Receipt Guidelines:

- Receipts are required for ALL transactions regardless of dollar amount.

- If a receipt is missing, the cardholder should add a note to the transaction description stating they could not obtain a receipt and the reason why. Missing receipts should not be a regular occurrence.

- If any transaction $50 or over is missing a receipt, the cardholder must submit a Missing Receipt Declaration and upload the completed form to the expense as the receipt. For federal grants, all receipts must be submitted, regardless of dollar amount.

- Please note: this $50 threshold ONLY applies when a Missing Receipt Declaration is required to be submitted. It does not mean that the cardholder only needs to submit receipts for transactions that are $50 or more. We are externally audited for purchases of all amounts, so we require receipts for every purchase as much as possible.

- All receipts should be itemized and show what was purchased. Meal receipts must also include the written tip amount; the amount on the receipt must match what is on the statement.

- Mileage receipts can be made using a screenshot of Google maps showing the distance between your destinations.

Login

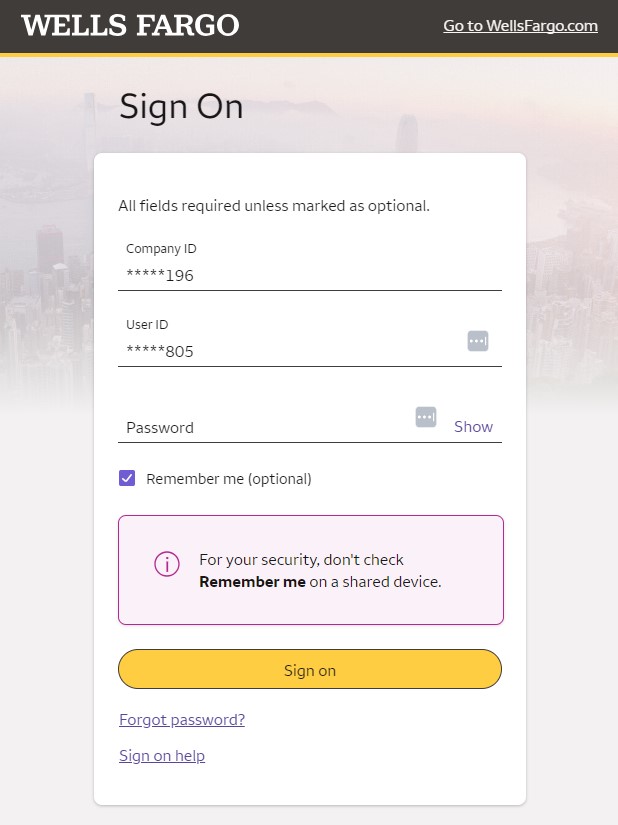

Go to the Wells Fargo Commercial Electronic Office sign on page. Please note: this is a special sign on website for commercial/business cards. You will not be able to access your account via the regular Wells Fargo website for individual/personal accounts.

Enter in the Company ID: MACAL196, Your User ID, and Password. Click “Sign On”.

If you receive an error message, try one more time. If you are still unsuccessful, use the Forgot Password link to try and reset your password. If it won’t allow you to reset your password, contact the Pcard Administrator to request a password reset.

From this CEO home page, click on Payments & Transfers. In the sub menu, click on WellsOne Expense Manager to view your Pcard account.

Review Expenses

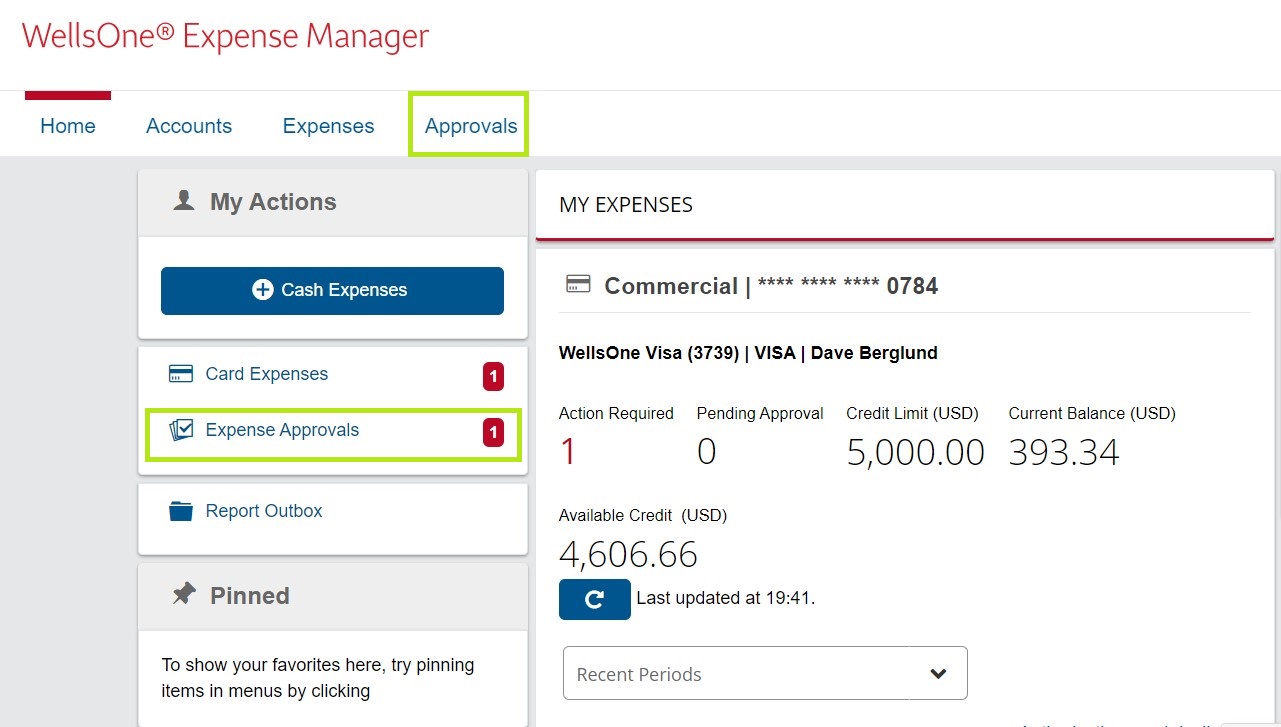

The Home Page will show you a quick run down of your monthly credit limit and your remaining available credit if you have your own Pcard. You can see if you have any outstanding expenses to approve on the left side below the blue Cash Expenses button; it will say Expense Approvals followed by the number of expenses you have to approve currently. To approve your cardholder’s expenses, you can click that button, or click the Approvals tab in your top menu.

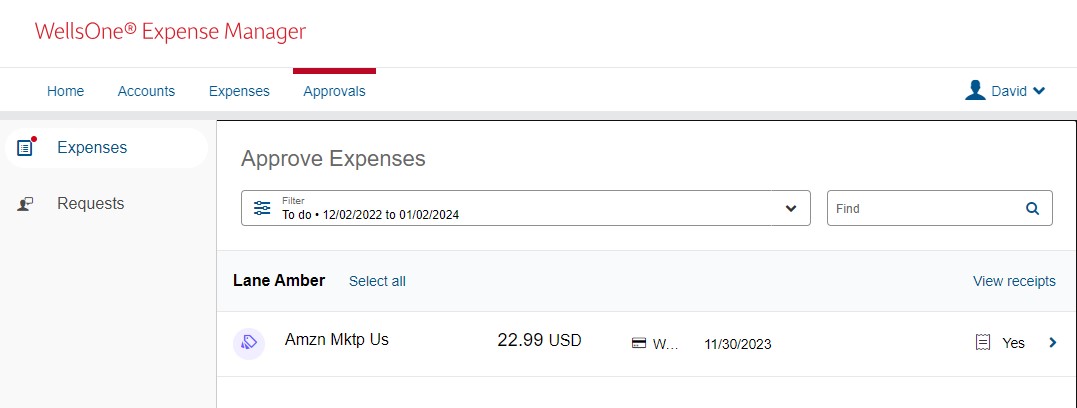

The default view is set to show expenses that still require review and approval. Approving expenses operates almost the exact same way as if you were reviewing your own Pcard expenses. Click on the expense you want to review.

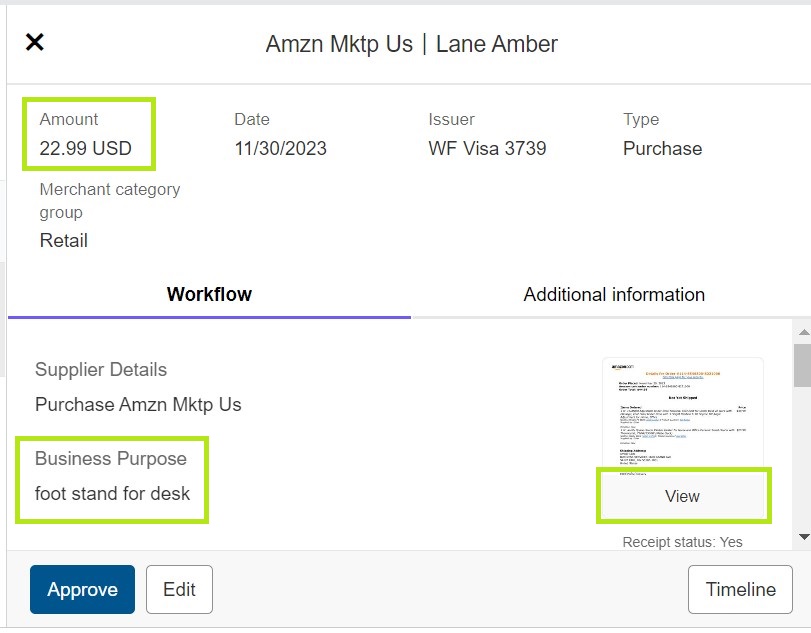

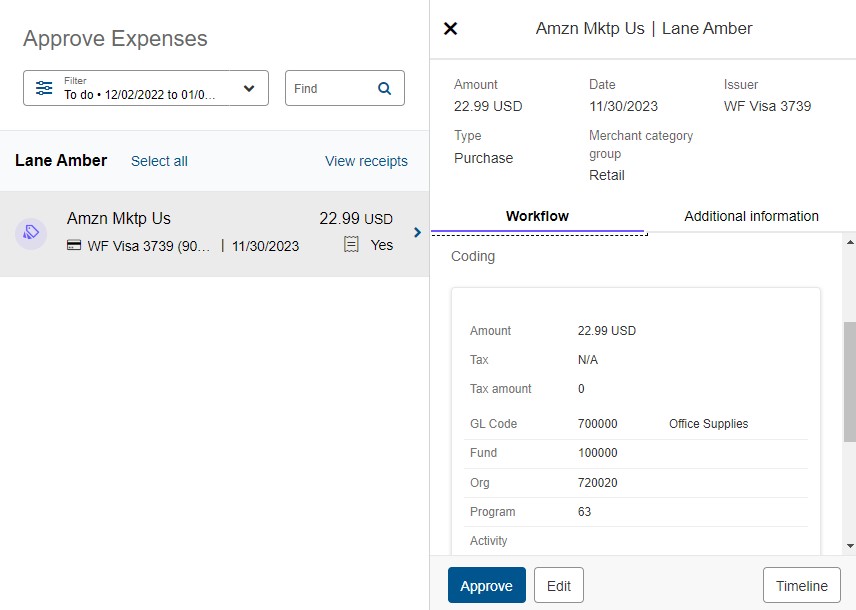

Once the expense opens, you can see the basic transaction details on top. The cardholder should have entered a valid Description (Business Purpose) of the expense and uploaded the receipt. Review the description, and then click View on the Receipt to see an enlarged version and verify the correct receipt was attached and that the expense was work related.

Close the receipt window once you’ve finished viewing the enlarged version. Back on the expense, you can scroll down to view the FOAPAL the cardholder assigned the expense to. Verify that the Fund, Org, Account, Program, Activity, and Location codes are correct. If everything is complete and correct, you can click the Approve button and continue on with the rest of your pending approvals. If there is an inappropriate description, incorrect FOAPAL, or no receipt was uploaded, you can either modify the expense yourself, or send it back to your cardholder to fix.

Modify Expenses

To update any transaction select the box next to the transaction number or click “Select All” and then “Reclassify.”

Each transaction needs a description and FOAPAL code. The Pcard is created with a default FUND, ORGANIZATION, and PROGRAM code. The ACCOUNT or General Ledger code switches based on the category of purchase. Wells Fargo is linked with Macalester’s accounting structure to select the appropriate Account code. However, it is not always correct.

To update the Account (General Ledger Code), first click the X by the incorrect code.

This automatically turns the incorrect code into a “small magnifying glass” that when clicked brings up an Account code menu.

Select the most appropriate “Account Code” (General Ledger Code) from the pop-up menu.

You can update the FUND, ORG (Organization), PROGRAM, ACTIVITY, and LOCATION codes by clicking in each box and retyping the appropriate code. Review or edit the “Description”

The description should provide a clear business purpose for the transaction. Descriptions do not have to be long or full sentences.

Good Examples:

Lunch with J. Smith about reunion 2018

Donor meeting with J. Smith class of ‘72

Breakfast bagels for staff meeting

J. Smith Flight on 8/24/17 to AAA conference

J. Smith AAA conference registration (8/15-8/18)

Standard office supplies – pens, post it notes, paper, ect.

Test tubes for J. Smith Research Grant

Gift Card for student worker, J. Smith – end of year thank you

Personal Charge – used wrong card

If needed you can Split a transaction between multiple FOAPAL’s.

To Split a transaction, select the transaction and click Split & Reclassify

For each part of the split, select the “account code” (general ledger code) from the menu located in the magnifying glass, the “amount”, and “description.” You may have to overwrite the “Fund”, “Organization”, and “Program” codes. You can also add more splits. Split transactions can used to split the cost between two or more FOAPAL codes. It is also helpful when only part of a charge is personal. In this case, only select the personal box on the amount that you are reimbursing Macalester. When finished click “Save” and “Return to Charges.”

If necessary, you can mark a charge as “Personal.” By checking the personal box, Wells Fargo will automatically withdraw the funds from the cardholder’s personal account and reimburse Macalester around the 14th of the month when the statement closes. They will receive an email from Wells Fargo with the total amount to be withdrawn.

It is helpful for the program administrator if the description for a personal charge starts with ‘Personal Expense-…’

The financial auditors prefer to have receipts for all transactions including personal expenses however, they are not mandatory.

It is important to check if the cardholder has added Out of Pocket Expenses. This tab has its own editing and approval functions. You can select individual transactions to approve or decline. You can also approve the entire statement. If these Out of Pocket transaction are not approved during the same month as they are added by the cardholder they will list as pending approval each month until a decision is made. Unless the transactions are approved the cardholder will not be reimbursed.

When you return to your list of cardholders the status of the card will have updated to Approved instead of Cardholder Reviewed or Open. However, the status only reflects the charges statement. You must look at the individual Out of Pocket expenses to verify the status.

Please contact the Pcard Administrator with any additional questions Pcard Administrator.